NORFOLK, Va. (September 28, 2015) – Homes.com®

Markets are recovering, perfect time to get that business loan or private money loan, take advantage of the market.

Leading online real estate destination, has released its July 2015 Local Market Index, a price performance summary of repeat sales in the top 100 markets, and the companion Midsize Markets Report for the next 200 largest markets. Among the nation’s top 300 markets, 166 or 55 percent have now achieved full price recovery — 24 more than the 142 markets reported in June.

By July, 50 of the nation’s 100 largest markets experienced a complete price recovery, one more than the prior month. Additionally, 116 out of 200 midsize markets saw a complete price recovery, 23 more than reported in June.*

July saw 16 of the top 100 markets post a decline in their 3-month averages. The long-term view remains robust though, with all 100 markets continuing to post year-over-year gains.

“We’ve reached an important benchmark in the U.S. housing market with the majority of the nation’s top 300 markets recovering at least their peak prices. Most homeowners in these markets have now regained lost equity from the housing crash, and we’re seeing good progress toward restoring equity to the remainder of the nation,” said David Mele, president of Homes.com.

Southern Markets Lead Recovery; West Remains Dominant in Annual Gains

As of July, 50 out of the top 100 markets had shown a complete price recovery. Richmond, VA rebounded at 100.18 and became the 50th market among the top 100 to achieve that status.

Of the 200 midsize markets, 116 have now achieved a complete price recovery. The most recent midsize markets to reach rebound status include Grand Junction, CO; Hattiesburg, MS; Springfield, MO; Charlottesville, VA; Olympia-Tumwater, WA; Niles-Benton Harbor, MI; Dalton, GA; Tupelo, MS; Dothan, AL; Athens-Clarke County, GA; Muskegon, MI; Montgomery, AL; Duluth, MN-WI; Eugene, OR; and Fayetteville-Springdale-Rogers, AR-MO.

Of the top 100 markets, the markets with minimal price declines from peak prices before the housing crash have achieved an average rebound of 109 percent. The average rebound of the moderate price decline markets was 101 percent of the prior peak price. Of the severe price decline markets, the average rebound was 84 percent.

The South continued to dominate recovery among the top 100 markets in July, with 23 markets recovered, followed by the Midwest with 11 markets fully recovered. Both the West and South had eight markets each that have achieved rebound status.

National Summary – West Continues to Dominate Annual Gains

Boise City, ID edged out Denver-Aurora-Lakewood, CO and San Francisco-Oakland-Hayward, CA in July for the top spot with an annual percentage change of 7.09 percent. Strong progress continues in the West where nine of ten of the top performing markets are located. However, that was one fewer than in June, with Grand Rapids-Wyoming, MI making the list. Within the West, California continued to dominate with four of the ten top markets.

Bridgeport-Stamford-Norwalk, CT posted the largest 3-month average gain in July at 0.59 percent, followed by other markets in the Northeast including Springfield, MA which had the second highest increase at 0.52 percent, and Providence-Warwick, RI-MA and Worcester, MA-CT that occupied the fifth and seventh places, respectively.

From a regional perspective, the market with the largest 3-month average gain of 0.59 percent was located in the Northeast. This was followed by the West at 0.48 percent. The Northeast also had the worst performing market in July at -0.19 percent.

Largest Markets Summary

Western markets continued to lead the recovery among top 100 markets. Markets with the highest rebound percentages were Dallas-Fort Worth-Arlington, TX (115.43 percent); Denver-Aurora-Lakewood, CO (113.41 percent); Austin-Round Rock, TX (113.32 percent); Houston-The Woodlands-Sugar Land, TX (112.84 percent); and San Antonio-New Braunfels, TX (112.76 percent).

Large markets trailing the national rebound were those that suffered large numbers of foreclosures and price declines during the housing crash. The bottom five markets by rebound percentage were Deltona-Daytona Beach-Ormond Beach, FL (72.49 percent); Palm Bay-Melbourne-Titusville, FL (71.72 percent); Cape Coral-Fort Myers, FL (71.21 percent); Stockton-Lodi, CA (70.61 percent); and Las Vegas-Henderson-Paradise, NV (68.47 percent).

On a year-over-year basis, the West also dominated. The top five markets achieving annualized gains were Boise City, ID; Denver-Aurora-Lakewood, CO; San Francisco-Oakland-Hayward, CA; Seattle-Tacoma-Bellevue, WA; and San Jose-Sunnyvale-Santa Clara, CA.

Top performing markets by region were Bridgeport-Stamford-Norwalk, CT; Stockton-Lodi, CA; Toledo, OH; and Augusta-Richmond County, GA-SC.

Western Region Dominates Midsize Markets; Midwest Markets Gaining

The midsize market with the best 3-month average growth in July was Bangor, ME which increased 0.88 percent. It was followed by Gainesville, GA which grew by 0.56 percent. Nearly all of the top-performing midsize markets on a 3-month basis were located in the eastern portion of the U.S., with strength particularly focused in the Northeast.

Though western markets continued to lead the list of midsize markets achieving rebound status on an annualized basis, midwestern markets have begun to move into the top ten. Appleton, WI and Racine, WI, made the Top 10 midsize list in July with year-over-year gains of 7.07 percent and 7.03 percent, respectively.

In July, 164 of 200 midsize markets increased their 3-month averages, down from 197 the prior month. The greatest number of decreasing markets was found in the southern region (16) and the northeast region (10). As was the case with the top 100, all midsize markets continued to show year-over-year gains.

Midsize Markets by Region and Division:

All five of the markets posting the best 3-month gains were eastern: Bangor, ME; Gainesville, GA; Rocky Mount, NC; Manchester-Nashua, NH; and Blacksburg-Christiansburg-Radford, VA.

Short-term strength was seen in the East, with the top performing markets located in the New England and South Atlantic regions.

Short-term weakness was seen in the East South Central division and the Mid-Atlantic division.

To receive a comprehensive data file, including index values in every zip code within a local market, contact LocalMarketReports@Homes.com. To download a copy of the reports, visit press.homes.com.

Wednesday, September 30, 2015

Tuesday, September 29, 2015

Do realtors today utilize funds from private money lenders to close more transactions and cultivate the housing market ?

As seen on Gazette September 28, 2015 at 8:16 am

Homeownership has proven throughout history to be a worthwhile dynamic in America, benefiting families as well as communities. Although a drop in homeownership in recent years marks the largest decline since the great depression, homeownership continues to be a fundamental pursuit for most Americans.

Unlike common perception, real estate is not a business about houses, rather real estate is a business about people. The National Association of REALTORS® (NAR) happens to be the largest trade association in the U.S. and they are advocating every day on behalf of property owners, as well as aspiring homeowners.

At a national level, NAR promotes efforts to facilitate homeownership and property rights, The Colorado Association of REALTORS® (CAR) advocates for the same purposes at the State level, and the Pikes Peak Association of REALTORS® (PPAR) strives to safeguard homeownership throughout the Pikes Peak Region.

NAR is currently challenging the Tax Reform Act of 2014 by House Ways and Means Chairman, David Camp, which would repeal the mortgage interest deduction and replace it with a standard deduction.

Since its inception, the mortgage interest deduction (MID) has been a successful means to facilitate homeownership, and NAR is fervently opposed to any type of modification that would potentially limit or weaken that resource for consumers.

Regarding the proposed reform, Pikes Peak Association of REALTORS® Chairman of the Board Cherri Fischer, said “REALTORS® support reforms that promote economic growth, but we strongly oppose severely altering the rules that govern ownership and investment in real estate. Real estate powers almost one-fifth of the U.S. economy, employs more than 17 million Americans, and contributes a quarter of all federal and state tax revenue and as much as 70 percent of local taxes nationwide.”

Known as TILA-RESPA Integrated Disclosure (TRID), CFPD is implementing two new disclosure forms to outline the loan estimate and the loan closing. The intention of CFPD is to simplify loan documentation, limit fees for consumers, aid homebuyers in comparison shopping, and make documentation easier to understand.

However, the new TRID regulation is certain to disrupt and delay closings. Some experts are estimating that 60 day loan approvals will be standard, and the new forms will confuse buyers.

The country is experiencing one of the strongest spring markets in a decade, but there is concern that the new TRID rules will initiate an insecure fall market.

Closer to home, the Colorado Association of REALTORS® and the Pikes Peak Association of REALTORS® have launched efforts to introduce Project Wildfire.

Unfortunately, large and destructive wildfires have claimed hundreds of thousands of acres of Colorado land, destroyed homes and structures, caused deaths and injuries, and displaced a number of residents. Projected growth of the state’s Wildland Urban Interface (WUI) areas, assures that the wildfire threat will persist.

Colorado REALTORS® are partnering with fire prevention organizations across the state to bring education and awareness, as well as resources to residents and communities.

In addition, flood insurance has put homeowners throughout the state of Colorado in a complex predicament. The National Flood Insurance Program through the Federal Emergency Management Agency (FEMA) is intended to reduce the effect of flooding on private and public structures.

Urging communities to adopt and enforce floodplain management regulations and by providing affordable insurance for property owners, FEMA drives to mitigate the impact of flooding on structures, and the socio-economic impact of flooding disasters.

Both local and national REALTOR® representatives are steadfast supporters of efforts to renew and reinforce the long-term sustainability of the federal flood insurance program, in addition to maintaining funding to update and improve the accuracy of flood maps.

Every day, REALTORS® are endeavoring behind the scenes to advocate for and protect homeowner interests at every level of government as well as to promote a sound and dynamic U.S. real estate market and cultivate successful communities.

It seems likely that hard money loans contribute to and support easier requirements for non-owner occupied real estate investments which lead to home price appreciation and more equity for the average home owner.

“REALTORS® are a potent force in cultivating and

protecting homeownership in America

Homeownership has proven throughout history to be a worthwhile dynamic in America, benefiting families as well as communities. Although a drop in homeownership in recent years marks the largest decline since the great depression, homeownership continues to be a fundamental pursuit for most Americans.

It’s possible that the latest decline of homeownership could be made worse if the mortgage interest deduction is diminished or the housing finance system is reformed in a way that makes debt financing less attainable for purchasing a home. Safeguarding policies that facilitate sustainable homeownership is a vital focus for REALTORS® across the country.

Unlike common perception, real estate is not a business about houses, rather real estate is a business about people. The National Association of REALTORS® (NAR) happens to be the largest trade association in the U.S. and they are advocating every day on behalf of property owners, as well as aspiring homeowners.

At a national level, NAR promotes efforts to facilitate homeownership and property rights, The Colorado Association of REALTORS® (CAR) advocates for the same purposes at the State level, and the Pikes Peak Association of REALTORS® (PPAR) strives to safeguard homeownership throughout the Pikes Peak Region.

NAR is currently challenging the Tax Reform Act of 2014 by House Ways and Means Chairman, David Camp, which would repeal the mortgage interest deduction and replace it with a standard deduction.

Since its inception, the mortgage interest deduction (MID) has been a successful means to facilitate homeownership, and NAR is fervently opposed to any type of modification that would potentially limit or weaken that resource for consumers.

Regarding the proposed reform, Pikes Peak Association of REALTORS® Chairman of the Board Cherri Fischer, said “REALTORS® support reforms that promote economic growth, but we strongly oppose severely altering the rules that govern ownership and investment in real estate. Real estate powers almost one-fifth of the U.S. economy, employs more than 17 million Americans, and contributes a quarter of all federal and state tax revenue and as much as 70 percent of local taxes nationwide.”

REALTORS® are also actively campaigning to prevent limiting access to buyers as a result of the Consumer Financial Protection Bureau’s (CFPB) merger of the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA).

Known as TILA-RESPA Integrated Disclosure (TRID), CFPD is implementing two new disclosure forms to outline the loan estimate and the loan closing. The intention of CFPD is to simplify loan documentation, limit fees for consumers, aid homebuyers in comparison shopping, and make documentation easier to understand.

However, the new TRID regulation is certain to disrupt and delay closings. Some experts are estimating that 60 day loan approvals will be standard, and the new forms will confuse buyers.

The country is experiencing one of the strongest spring markets in a decade, but there is concern that the new TRID rules will initiate an insecure fall market.

Closer to home, the Colorado Association of REALTORS® and the Pikes Peak Association of REALTORS® have launched efforts to introduce Project Wildfire.

Unfortunately, large and destructive wildfires have claimed hundreds of thousands of acres of Colorado land, destroyed homes and structures, caused deaths and injuries, and displaced a number of residents. Projected growth of the state’s Wildland Urban Interface (WUI) areas, assures that the wildfire threat will persist.

Colorado REALTORS® are partnering with fire prevention organizations across the state to bring education and awareness, as well as resources to residents and communities.

Project Wildfire addresses the most effective ways to minimize future wildfire destruction by combining education with monetary incentives and access to local resources. Without practical, preemptive steps by homeowners, the likelihood for increased property related expenses will escalate, as well as amplifying insurance premiums.

In addition, flood insurance has put homeowners throughout the state of Colorado in a complex predicament. The National Flood Insurance Program through the Federal Emergency Management Agency (FEMA) is intended to reduce the effect of flooding on private and public structures.

Urging communities to adopt and enforce floodplain management regulations and by providing affordable insurance for property owners, FEMA drives to mitigate the impact of flooding on structures, and the socio-economic impact of flooding disasters.

Both local and national REALTOR® representatives are steadfast supporters of efforts to renew and reinforce the long-term sustainability of the federal flood insurance program, in addition to maintaining funding to update and improve the accuracy of flood maps.

Every day, REALTORS® are endeavoring behind the scenes to advocate for and protect homeowner interests at every level of government as well as to promote a sound and dynamic U.S. real estate market and cultivate successful communities.

It seems likely that hard money loans contribute to and support easier requirements for non-owner occupied real estate investments which lead to home price appreciation and more equity for the average home owner.

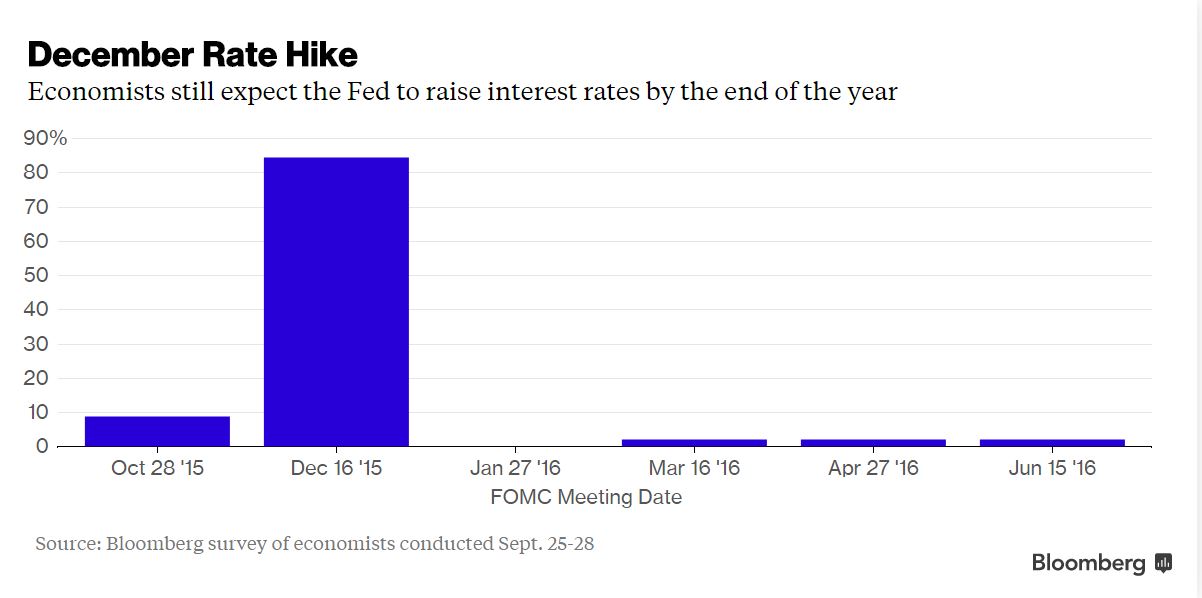

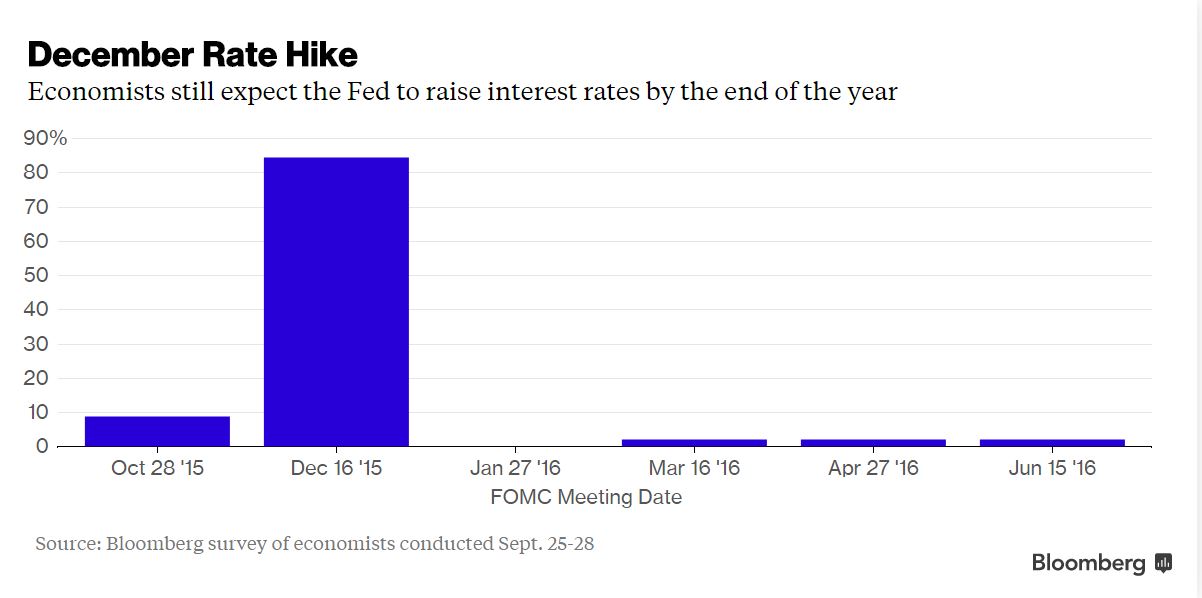

Will the Federal Reserve raise interest rates by the end of the year?

Markets vs. Economists: Who's Right on Fed Interest-Rate Timing?

By: Bloomberg Business September 29, 2015 - 8:13 AM PDT

The economists’ view falls in line with Fed officials, three of whom have signaled within the past week that liftoff is looming. Markets are more questioning. In the past, policy makers have voiced concern about surprising the bond market with their decision. Even so, the current discrepancy didn’t bother New York Fed President William C. Dudley.

The economists’ view falls in line with Fed officials, three of whom have signaled within the past week that liftoff is looming. Markets are more questioning. In the past, policy makers have voiced concern about surprising the bond market with their decision. Even so, the current discrepancy didn’t bother New York Fed President William C. Dudley.

By: Bloomberg Business September 29, 2015 - 8:13 AM PDT

Eighty-four percent of economists surveyed by Bloomberg expect an initial interest-rate increase in December, according to a survey conducted Sept. 25-28. That contrasts with the signal federal funds futures are sending: Pricing suggests that investors see a roughly 40 percent probability of a rate rise by year end, based on an assumption that the effective funds rate will trade at the 0.375 percent mid-point of the target range following Fed liftoff.

“It’s not for me to say what the market expectation should be,” he told a Wall Street Journal event Monday in New York, acknowledging that the Fed and economists have been consistently overly optimistic on growth and rates in recent years. “It could be that the market view is, that, yes, we hear you that you expect to raise interest rates this year, but we think that the data is going to evolve in a way that’s going to cause you to change your mind.”

Chair Janet Yellen said last week that she still thinks liftoff from near zero is likely this year if the economy develops as projected, and both Dudley and San Francisco Fed President John Williams echoed that expectation in separate speeches Monday. Chicago Fed President Charles Evans, who favors delaying until 2016, indicated that he still sees room for patience before lifting rates, in remarks also made on Monday.

The economist survey shows that most forecasters who called for a rate increase in September pushed back to December, rather than moving their projection into October or 2016. A pre-FOMC meeting survey of economists earlier this month showed 56 percent expecting September, 14 percent October and 25 percent December. Just 5 percent saw a 2016 liftoff.

In the most recent survey, fewer than 10 percent look for a rate increase next month, and only about 7 percent expect the Fed to wait until next year.

Monday, September 28, 2015

Dow tumbles 250 points on global economic jitters

Bloomberg - Monday September 28, 2015

Stocks fell sharply Monday, with equities down for a fifth consecutive session, as raw-material and energy shares retreated amid more signs of slowing in China while biotechnology companies extended last week’s selloff.

The Nasdaq Biotechnology Index sank 3.8 percent after its worst week since 2011. Freeport-McMoRan Inc. tumbled 8.8 percent as copper dropped to the lowest in a month amid evidence of industrial weakness in China. Schlumberger Ltd. and Marathon Oil Corp. lost at least 3.9 percent as oil prices slid. Alcoa Inc. rallied 4.7 percent after saying it will split into two publicly traded companies.

The Standard & Poor’s 500 Index fell 1.7 percent to 1,899.09 at 11:40 a.m. in New York, its lowest in a month. The Dow Jones Industrial Average lost 252 points, or 1.6 percent, to 16,062. The Nasdaq Composite Index dropped 2 percent.

“We are in a chaotic market, lots of volatility but not making much progress in either direction,” said James Gaul, a portfolio manager at Boston Advisors LLC, which oversees $2.8 billion. “Earnings are going to be really important this quarter considering the macro backdrop and general global fears as well as the concerns about the Fed potentially raising interest rates as early as next month.”

Equity markets have been turbulent in recent weeks amid confusion over the Federal Reserve’s tightening policy and concern over a slowdown in Asia. Data today showed profits of Chinese industrial companies fell the most since the country’s government began compiling data in 2011. Biotechnology shares tumbled on Friday, offsetting gains fueled by Fed Chair Janet Yellen’s reassurances that turbulence in emerging markets won’t harm U.S. growth.

Federal Reserve Bank of New York President William C. Dudley said today the central bank will “probably” raise interest rates later this year despite uncertainties over global growth. “I think that the economy is doing pretty well,” Dudley said at an event in New York. He said he expected growth in the second half will be “a little bit weaker” than in the first half.

A report today showed household spending climbed more than forecast in August and incomes also rose as the biggest part of the U.S. economy continued to power past a global slowdown. Separate data showed contract signings to purchase previously owned U.S. homes unexpectedly declined in August for just the second time this year, signaling residential real estate might have difficulty building on recent momentum.

Biotechs Battered

“Supposedly Yellen had clarified everything on Thursday, and yet the market still went down,” said Matt Maley, an equity strategist at Miller Tabak & Co LLC in New York. “It shows me that there are issues other than the Fed causing this decline. Biotechs have rolled over. The market narrowed through the summer, and we still had a couple of groups that were still acting pretty well, but they rolled over. We’re losing what little leadership we had left.”

The Nasdaq Biotech Index slid into a bear market on Friday amid its worst weekly decline in four years. The rout was sparked by a tweet last Monday from Democratic presidential hopeful Hillary Clinton suggesting there may be “price gouging” in the market for prescription drugs.

The S&P 500 is down 8 percent in the third quarter, poised for its worst fall since 2011, and on track Monday for its lowest close in a month. The benchmark is 11 percent below its all-time high set in May. The Chicago Board Options Exchange Volatility Index has closed above 20 for the past 25 sessions, the longest streak since 2012. The measure of market turbulence known as the VIX climbed 11 percent Monday to 26.24.

Stocks fell after the Fed’s decision to hold off raising rates on Sept. 17 raised questions about the impact of a global growth slowdown on the U.S. Despite Yellen signaling last week that the economy is sturdy enough to handle higher raise rates in 2015, traders are pricing in a 43 percent probability of the event in December and a 50 percent chance in January.

All of the S&P 500’s 10 main industries declined Monday, with materials, health-care and energy losing more than 2.3 percent. Eight groups decreased at least 1 percent.

Raw-materials companies fell for the seventh time in eight sessions, losing 9 percent during the span and declining to the lowest in more than two years. Freeport-McMoRan has slumped 24 percent since the Fed said it was considering spillover risks to the U.S. economy from turmoil in global markets. Dow Chemical and DuPont Co. dropped more than 1.9 percent on Monday.

Mylan NV, Regeneron Pharmaceuticals Inc. and Gilead Sciences Inc. lost at least 3.4 percent to pace the slide in health-care. The group is down 9.5 percent amid a seven-day losing streak, the longest since August 2011. Pfizer Inc. and Merck & Co. retreated more than 1.6 percent.

Stocks fell sharply Monday, with equities down for a fifth consecutive session, as raw-material and energy shares retreated amid more signs of slowing in China while biotechnology companies extended last week’s selloff.

The Nasdaq Biotechnology Index sank 3.8 percent after its worst week since 2011. Freeport-McMoRan Inc. tumbled 8.8 percent as copper dropped to the lowest in a month amid evidence of industrial weakness in China. Schlumberger Ltd. and Marathon Oil Corp. lost at least 3.9 percent as oil prices slid. Alcoa Inc. rallied 4.7 percent after saying it will split into two publicly traded companies.

The Standard & Poor’s 500 Index fell 1.7 percent to 1,899.09 at 11:40 a.m. in New York, its lowest in a month. The Dow Jones Industrial Average lost 252 points, or 1.6 percent, to 16,062. The Nasdaq Composite Index dropped 2 percent.

“We are in a chaotic market, lots of volatility but not making much progress in either direction,” said James Gaul, a portfolio manager at Boston Advisors LLC, which oversees $2.8 billion. “Earnings are going to be really important this quarter considering the macro backdrop and general global fears as well as the concerns about the Fed potentially raising interest rates as early as next month.”

Equity markets have been turbulent in recent weeks amid confusion over the Federal Reserve’s tightening policy and concern over a slowdown in Asia. Data today showed profits of Chinese industrial companies fell the most since the country’s government began compiling data in 2011. Biotechnology shares tumbled on Friday, offsetting gains fueled by Fed Chair Janet Yellen’s reassurances that turbulence in emerging markets won’t harm U.S. growth.

Federal Reserve Bank of New York President William C. Dudley said today the central bank will “probably” raise interest rates later this year despite uncertainties over global growth. “I think that the economy is doing pretty well,” Dudley said at an event in New York. He said he expected growth in the second half will be “a little bit weaker” than in the first half.

A report today showed household spending climbed more than forecast in August and incomes also rose as the biggest part of the U.S. economy continued to power past a global slowdown. Separate data showed contract signings to purchase previously owned U.S. homes unexpectedly declined in August for just the second time this year, signaling residential real estate might have difficulty building on recent momentum.

Biotechs Battered

“Supposedly Yellen had clarified everything on Thursday, and yet the market still went down,” said Matt Maley, an equity strategist at Miller Tabak & Co LLC in New York. “It shows me that there are issues other than the Fed causing this decline. Biotechs have rolled over. The market narrowed through the summer, and we still had a couple of groups that were still acting pretty well, but they rolled over. We’re losing what little leadership we had left.”

The Nasdaq Biotech Index slid into a bear market on Friday amid its worst weekly decline in four years. The rout was sparked by a tweet last Monday from Democratic presidential hopeful Hillary Clinton suggesting there may be “price gouging” in the market for prescription drugs.

The S&P 500 is down 8 percent in the third quarter, poised for its worst fall since 2011, and on track Monday for its lowest close in a month. The benchmark is 11 percent below its all-time high set in May. The Chicago Board Options Exchange Volatility Index has closed above 20 for the past 25 sessions, the longest streak since 2012. The measure of market turbulence known as the VIX climbed 11 percent Monday to 26.24.

Stocks fell after the Fed’s decision to hold off raising rates on Sept. 17 raised questions about the impact of a global growth slowdown on the U.S. Despite Yellen signaling last week that the economy is sturdy enough to handle higher raise rates in 2015, traders are pricing in a 43 percent probability of the event in December and a 50 percent chance in January.

All of the S&P 500’s 10 main industries declined Monday, with materials, health-care and energy losing more than 2.3 percent. Eight groups decreased at least 1 percent.

Raw-materials companies fell for the seventh time in eight sessions, losing 9 percent during the span and declining to the lowest in more than two years. Freeport-McMoRan has slumped 24 percent since the Fed said it was considering spillover risks to the U.S. economy from turmoil in global markets. Dow Chemical and DuPont Co. dropped more than 1.9 percent on Monday.

Mylan NV, Regeneron Pharmaceuticals Inc. and Gilead Sciences Inc. lost at least 3.4 percent to pace the slide in health-care. The group is down 9.5 percent amid a seven-day losing streak, the longest since August 2011. Pfizer Inc. and Merck & Co. retreated more than 1.6 percent.

Wednesday, September 23, 2015

Deeper China downturn, weak Europe and U.S. dents global growth outlook

REUTERS Markets Wed Sep 23, 2015 11:05am EDT

The outlook for the global economy became bleaker on Wednesday as signs of a deeper manufacturing downturn in China emerged, coupled with slow growth in Europe and the United States.

"There is substantial concern at present that global demand weakness is dampening the economy in the industrial countries," said Jorg Kramer, chief economist at Commerzbank.

China's factory sector activity shrank at its fastest rate in more than 6 years in September, according to the monthly Caixin/Market survey, sending investors worried about sagging global growth scurrying out of risky assets.

The preliminary Caixin/Markit purchasing managers' index (PMI) for China fell to 47.0, the worst since March 2009, missing expectations for 47.5 and slipping from August's 47.3. Levels below 50 signify a contraction.

It was the seventh straight month of contraction for the Chinese manufacturing sector and the survey showed business conditions deteriorating almost across the board, as firms reduced output, prices and jobs at a faster pace as orders fell.

The data underline the malaise in the world's second largest economy and just how difficult it will be for policymakers to steer the economy out of the biggest downturn in decades.

Last month, Beijing devalued the currency to support exports and boost growth, currently at 7.0 percent according to official data.

But that move was seen by investors as official endorsement of a slowing economy. A global financial market rout, notably in Chinese stocks, followed and forced the central bank to cut interest rates again, the fifth time since November.

China is a major importer of raw materials, especially from Australia, South Africa and Canada, and an exporter of finished goods. The slowdown in China is denting demand in emerging market countries which are dependent on commodity exports in particular.

Last week, the global market volatility of the past month figured high on a list of reasons the Federal Reserve did not raise U.S. interest rates as many expected for the first time in almost a decade.

Overall in Asia, sentiment at the biggest companies tumbled at a record pace in the third quarter on worries about China and the risks it poses to global growth, a Thomson Reuters/INSEAD survey showed.

There are signs dwindling demand from Asia, led by China, is starting to hurt businesses in the euro zone, according to PMI survey compiler Markit.

Private business growth in the currency bloc slowed this month as Asian demand weakened, leading to fewer new jobs and forcing factories to reduce output.

The Markit Composite Flash PMI for the bloc came in at 53.9 in September against predictions of 54.1, down from 54.3 last month. Markit said the PMIs point to third-quarter growth of 0.4 percent.

"It is hard to see euro zone growth really kicking on," said Howard Archer at IHS Global Insight.

"There is the very real risk that slowing growth in emerging markets like China not only hits euro zone exports but also has a negative impact on business sentiment and leads to a scaling back of investment and employment plans."

Business activity in Germany, the euro zone's biggest economy, slowed slightly in September while activity rebounded in France as manufacturing output swung back to growth after two consecutive months of decline.

Growth in the U.S. manufacturing sector showed no month-over-month change during September, staying at August's sluggish pace which was the weakest in almost two years, according to Markit.

The preliminary U.S. Manufacturing PMI for September was 53, the same as August, which was its lowest since October 2013.

Economists polled by Reuters had forecast the September figure would be 53.0.

Job creation in the sector also slowed, with the index at 51.4, its weakest since July 2014, down from a final August reading of 52.4.

A strong dollar, flagging demand in many export markets and reduced capital spending by energy and other companies all dragged on U.S. manufacturing, according to Chris Williamson, chief economist at Markit.

"The survey is indicating the weakest manufacturing growth for almost two years, meaning the sector will have acted as a drag on the economy in the third quarter," Williamson said.

(Reporting by Xiaoyi Shao, Meng Meng, Kevin Yao, Sumanta Dey, and Michael Connor; Editing by Clive McKeef and Meredith Mazzilli)

The outlook for the global economy became bleaker on Wednesday as signs of a deeper manufacturing downturn in China emerged, coupled with slow growth in Europe and the United States.

"There is substantial concern at present that global demand weakness is dampening the economy in the industrial countries," said Jorg Kramer, chief economist at Commerzbank.

China's factory sector activity shrank at its fastest rate in more than 6 years in September, according to the monthly Caixin/Market survey, sending investors worried about sagging global growth scurrying out of risky assets.

The preliminary Caixin/Markit purchasing managers' index (PMI) for China fell to 47.0, the worst since March 2009, missing expectations for 47.5 and slipping from August's 47.3. Levels below 50 signify a contraction.

It was the seventh straight month of contraction for the Chinese manufacturing sector and the survey showed business conditions deteriorating almost across the board, as firms reduced output, prices and jobs at a faster pace as orders fell.

The data underline the malaise in the world's second largest economy and just how difficult it will be for policymakers to steer the economy out of the biggest downturn in decades.

Last month, Beijing devalued the currency to support exports and boost growth, currently at 7.0 percent according to official data.

But that move was seen by investors as official endorsement of a slowing economy. A global financial market rout, notably in Chinese stocks, followed and forced the central bank to cut interest rates again, the fifth time since November.

China is a major importer of raw materials, especially from Australia, South Africa and Canada, and an exporter of finished goods. The slowdown in China is denting demand in emerging market countries which are dependent on commodity exports in particular.

Last week, the global market volatility of the past month figured high on a list of reasons the Federal Reserve did not raise U.S. interest rates as many expected for the first time in almost a decade.

Overall in Asia, sentiment at the biggest companies tumbled at a record pace in the third quarter on worries about China and the risks it poses to global growth, a Thomson Reuters/INSEAD survey showed.

There are signs dwindling demand from Asia, led by China, is starting to hurt businesses in the euro zone, according to PMI survey compiler Markit.

Private business growth in the currency bloc slowed this month as Asian demand weakened, leading to fewer new jobs and forcing factories to reduce output.

The Markit Composite Flash PMI for the bloc came in at 53.9 in September against predictions of 54.1, down from 54.3 last month. Markit said the PMIs point to third-quarter growth of 0.4 percent.

"It is hard to see euro zone growth really kicking on," said Howard Archer at IHS Global Insight.

"There is the very real risk that slowing growth in emerging markets like China not only hits euro zone exports but also has a negative impact on business sentiment and leads to a scaling back of investment and employment plans."

Business activity in Germany, the euro zone's biggest economy, slowed slightly in September while activity rebounded in France as manufacturing output swung back to growth after two consecutive months of decline.

Growth in the U.S. manufacturing sector showed no month-over-month change during September, staying at August's sluggish pace which was the weakest in almost two years, according to Markit.

The preliminary U.S. Manufacturing PMI for September was 53, the same as August, which was its lowest since October 2013.

Economists polled by Reuters had forecast the September figure would be 53.0.

Job creation in the sector also slowed, with the index at 51.4, its weakest since July 2014, down from a final August reading of 52.4.

A strong dollar, flagging demand in many export markets and reduced capital spending by energy and other companies all dragged on U.S. manufacturing, according to Chris Williamson, chief economist at Markit.

"The survey is indicating the weakest manufacturing growth for almost two years, meaning the sector will have acted as a drag on the economy in the third quarter," Williamson said.

(Reporting by Xiaoyi Shao, Meng Meng, Kevin Yao, Sumanta Dey, and Michael Connor; Editing by Clive McKeef and Meredith Mazzilli)

Tuesday, September 15, 2015

U.S. Gasoline Prices at Lowest Levels Since 2008 Recession

Monday September 14, 2015 Source: MSN Money

Analyst are expecting oil prices to decline because a strong dollar would decrease demand from importing countries.

Gas prices in the United States are at their lowest levels since the 2008 recession, with a nationwide average of $2.44 per gallon. According to Lundberg Survey, of 2,500 filling stations surveyed gas prices have dropped 27 cents in the past three weeks.

"Consumers are winners at this point," the survey noted. "It is a big historical discount to last year." Drivers are now paying over a dollar less a gallon for gas compared to a year ago. We're seeing prices fall because gasoline supply is growing, Lundberg said.

Charleston, S.C., had the cheapest gas prices at $1.94 per gallon. But on the opposite side of the country, drivers paid $3.31 per gallon for gas in Los Angeles. Overall, oil prices have dropped nearly 60% since June of last year.

Additionally, oil futures are also being weighed down by China's economic crisis. The world's second-largest economy reported factory production and fixed-asset investment fell short of economists' forecasts in August, according to Reuters. Anticipation the Federal Reserve will increase interest rates later this week added more pressure on oil futures. If the U.S. central bank decides to do so, analysts are expecting oil prices to decline because a stronger dollar would decrease demand from importing countries.

Meanwhile, the Organization of Petroleum Exporting Countries reduced its oil supplies forecast by 72,000 barrels a day to 880,000 barrels a day. Despite this positive news, oil prices are expected to continue falling in the next coming weeks. Lundberg added that gas prices could go down another 4 cents to 10 cents per gallon.

Will the Fed increase interest rates this week and will that derive the price of oil down?

NEW YORK (TheStreet) -- Good news, consumers -- here's a price that is coming down.Analyst are expecting oil prices to decline because a strong dollar would decrease demand from importing countries.

Gas prices in the United States are at their lowest levels since the 2008 recession, with a nationwide average of $2.44 per gallon. According to Lundberg Survey, of 2,500 filling stations surveyed gas prices have dropped 27 cents in the past three weeks.

"Consumers are winners at this point," the survey noted. "It is a big historical discount to last year." Drivers are now paying over a dollar less a gallon for gas compared to a year ago. We're seeing prices fall because gasoline supply is growing, Lundberg said.

Charleston, S.C., had the cheapest gas prices at $1.94 per gallon. But on the opposite side of the country, drivers paid $3.31 per gallon for gas in Los Angeles. Overall, oil prices have dropped nearly 60% since June of last year.

Additionally, oil futures are also being weighed down by China's economic crisis. The world's second-largest economy reported factory production and fixed-asset investment fell short of economists' forecasts in August, according to Reuters. Anticipation the Federal Reserve will increase interest rates later this week added more pressure on oil futures. If the U.S. central bank decides to do so, analysts are expecting oil prices to decline because a stronger dollar would decrease demand from importing countries.

Meanwhile, the Organization of Petroleum Exporting Countries reduced its oil supplies forecast by 72,000 barrels a day to 880,000 barrels a day. Despite this positive news, oil prices are expected to continue falling in the next coming weeks. Lundberg added that gas prices could go down another 4 cents to 10 cents per gallon.

Thursday, September 10, 2015

Stocks rise in choppy trading on Apple bounce, oil rebound

Private Money Loans are less turbulent than the stock market.

Thursday, September 10, 2015 09:45 AM | Source: CNBC

Stocks rose Thursday as recovery in oil and major stocks offset increased uncertainty heading into the Federal Reserve's key meeting next week.

The Dow Jones industrial average traded about 20 points higher after earlier gaining more than 100 points in mid-morning trade with Apple and UnitedHealth (UNH) the greatest drivers. Biotechs and Apple advanced to briefly boost the Nasdaq 1 percent.

Apple (AAPL) briefly traded more than 2 percent higher, recovering losses from Wednesday when it unveiled new iPhones, the iPad Pro and other products.

"You have a rally in metals, a rally in oil, and here we are at the highs of the day," Peter Cardillo, chief market economist at Rockwell Global Capital, said of the mid-morning rally.

Crude oil reversed a 3.9 percent decline to briefly gain more than 3 percent to above $45.50 a barrel. Crude held higher after weekly inventory numbers showed a build of 2.6 million barrels, more than expected.

Natural gas inventories rose 68 billion cubic feet. Metals, including copper and gold, also gained more than half a percent.

The major averages shook off a mildly lower open to fluctuate between slight gains and losses. Futures reversed gains in premarket trade to turn lower, with the Dow futures briefly falling more than 100 points.

Some analysts attributed the decline in futures to hedge fund giant David Tepper's comments on CNBC's "Squawk Box" that held a cautious view of the stock market.

"He did not give a bullish tone to the market. He mentioned he's mostly cash," said John Caruso, senior market strategist at RJO Futures.

In early trade, the S&P 500 was about 4.2 percent above the closing low of the correction hit on Aug. 25. The Dow was also 4 percent above that level, while the Nasdaq was 5.8 percent above that level.

Of the S&P sectors, only utilities was trading below their Aug. 25 close.

"The market's got to do more work down at these levels. You've done a lot of technical damage to the market. ... I also think there's a little bit of confidence rebuilding that needs to occur because of what happened two weeks ago, which was a mini-flash crash," said Dan Veru, chief investment officer at Palisade Capital Management.

The Federal Open Market Committee could raise short-term interest rates for the first time in more than nine years at its meeting next Wednesday and Thursday.

"I think there's a little flight to safety," said Art Hogan, chief market strategist at Wunderlich Securities. "People are a little nervous about next week even though it's not today."

On the data front, initial jobless claims fell 6,000 to a seasonally adjusted 275,000 for the week ended Sept. 5, the Labor Department said on Thursday. It was the 27th straight week that claims remained below the 300,000 threshold, which is usually associated with a strengthening labor market.

U.S. import and export prices posted their largest drop in seven months.

Longer-term Treasury yields gained while the shorter-end held lower, with the 2-year yield at 0.73 percent and the 10-year yield at 2.21 percent.

The U.S. dollar traded flat against major world currencies, with the euro topping $1.12 and the yen near 121 yen against the greenback.

"The markets are starting to coil. The range of the (FX) market trends tend to get tighter as traders and investors (grow) uncertain ahead of next week's Fed meeting Wednesday," Caruso said.

Wholesale stockpiles declined 0.1 percent in July, missing expectations for a slight gain. Sales decreased 0.3 percent.

On the earnings front, Lululemon Athletica (LULU) beat estimates by one cent with quarterly profit of 34 cents per share, with revenue and a same store sales increase of six percent also exceeding forecasts.

Finisar (FNSR) and Zumiez (ZUMZ) are due to report after the bell.

In Europe, the pan-European STOXX 600 index was about 1 percent lower after weak data from Japan and China. Core machinery orders in Japan fell by 3.6 percent in July, while in China, the producer price index fell by 5.9 percent. Key major Asian stocks closed lower.

The Dow Jones industrial average (.DJI) traded up 87 points, or 0.53 percent, at 16,340, with Apple leading advancers and Wal-Mart (WMT) the greatest decliner.

The S&P 500 (.SPX) traded up 11 points, or 0.55 percent, at 1,952, with information technology leading eight sectors higher and energy and telecommunications the only decliners.

The Nasdaq (.IXIC) traded up 42 points, or 0.88 percent, at 4,798.

The CBOE Volatility Index (.VIX)(.VIX), widely considered the best gauge of fear in the market, traded near 26.

Nine stocks advanced for every five decliners on the New York Stock Exchange, with an exchange volume of 245 million and a composite volume of 1.0 billion in late morning trade.

Thursday, September 10, 2015 09:45 AM | Source: CNBC

Stocks rose Thursday as recovery in oil and major stocks offset increased uncertainty heading into the Federal Reserve's key meeting next week.

The Dow Jones industrial average traded about 20 points higher after earlier gaining more than 100 points in mid-morning trade with Apple and UnitedHealth (UNH) the greatest drivers. Biotechs and Apple advanced to briefly boost the Nasdaq 1 percent.

Apple (AAPL) briefly traded more than 2 percent higher, recovering losses from Wednesday when it unveiled new iPhones, the iPad Pro and other products.

"You have a rally in metals, a rally in oil, and here we are at the highs of the day," Peter Cardillo, chief market economist at Rockwell Global Capital, said of the mid-morning rally.

Crude oil reversed a 3.9 percent decline to briefly gain more than 3 percent to above $45.50 a barrel. Crude held higher after weekly inventory numbers showed a build of 2.6 million barrels, more than expected.

Natural gas inventories rose 68 billion cubic feet. Metals, including copper and gold, also gained more than half a percent.

The major averages shook off a mildly lower open to fluctuate between slight gains and losses. Futures reversed gains in premarket trade to turn lower, with the Dow futures briefly falling more than 100 points.

Some analysts attributed the decline in futures to hedge fund giant David Tepper's comments on CNBC's "Squawk Box" that held a cautious view of the stock market.

"He did not give a bullish tone to the market. He mentioned he's mostly cash," said John Caruso, senior market strategist at RJO Futures.

In early trade, the S&P 500 was about 4.2 percent above the closing low of the correction hit on Aug. 25. The Dow was also 4 percent above that level, while the Nasdaq was 5.8 percent above that level.

Of the S&P sectors, only utilities was trading below their Aug. 25 close.

"The market's got to do more work down at these levels. You've done a lot of technical damage to the market. ... I also think there's a little bit of confidence rebuilding that needs to occur because of what happened two weeks ago, which was a mini-flash crash," said Dan Veru, chief investment officer at Palisade Capital Management.

The Federal Open Market Committee could raise short-term interest rates for the first time in more than nine years at its meeting next Wednesday and Thursday.

"I think there's a little flight to safety," said Art Hogan, chief market strategist at Wunderlich Securities. "People are a little nervous about next week even though it's not today."

On the data front, initial jobless claims fell 6,000 to a seasonally adjusted 275,000 for the week ended Sept. 5, the Labor Department said on Thursday. It was the 27th straight week that claims remained below the 300,000 threshold, which is usually associated with a strengthening labor market.

U.S. import and export prices posted their largest drop in seven months.

Longer-term Treasury yields gained while the shorter-end held lower, with the 2-year yield at 0.73 percent and the 10-year yield at 2.21 percent.

The U.S. dollar traded flat against major world currencies, with the euro topping $1.12 and the yen near 121 yen against the greenback.

"The markets are starting to coil. The range of the (FX) market trends tend to get tighter as traders and investors (grow) uncertain ahead of next week's Fed meeting Wednesday," Caruso said.

Wholesale stockpiles declined 0.1 percent in July, missing expectations for a slight gain. Sales decreased 0.3 percent.

On the earnings front, Lululemon Athletica (LULU) beat estimates by one cent with quarterly profit of 34 cents per share, with revenue and a same store sales increase of six percent also exceeding forecasts.

Finisar (FNSR) and Zumiez (ZUMZ) are due to report after the bell.

In Europe, the pan-European STOXX 600 index was about 1 percent lower after weak data from Japan and China. Core machinery orders in Japan fell by 3.6 percent in July, while in China, the producer price index fell by 5.9 percent. Key major Asian stocks closed lower.

The Dow Jones industrial average (.DJI) traded up 87 points, or 0.53 percent, at 16,340, with Apple leading advancers and Wal-Mart (WMT) the greatest decliner.

The S&P 500 (.SPX) traded up 11 points, or 0.55 percent, at 1,952, with information technology leading eight sectors higher and energy and telecommunications the only decliners.

The Nasdaq (.IXIC) traded up 42 points, or 0.88 percent, at 4,798.

The CBOE Volatility Index (.VIX)(.VIX), widely considered the best gauge of fear in the market, traded near 26.

Nine stocks advanced for every five decliners on the New York Stock Exchange, with an exchange volume of 245 million and a composite volume of 1.0 billion in late morning trade.

Crude oil futures for October delivery gained $1.18 to $45.37 a barrel on the New York Mercantile Exchange. Gold futures gained $6.70 to $1,108.90 an ounce as of 11:05 a.m.

Subscribe to:

Posts (Atom)