We all know that the Federal Reserve would really like to get inflation back up to 2% or so in order that they may get on with raising interest rates so that we get back to having something like a normal financial economy. We’ve got the report today that one variant of the consumer price index, the core one, is now over 2%. So, that means the Fed will be raising pronto, right? Nope, sadly not, nothing is that easy. We’ve any number of different inflation indices and this isn’t the one that the Federal Reserve looks at when deciding upon interest rates. Sure, it’s indicative of the way things are going but it’s still just not the right inflation measure to hold the Fed to.

The news itself:

U.S. consumer prices moderated in May, but sustained increases in housing and healthcare costs kept underlying inflation supported, which could allow the Federal Reserve to raise interest rates this year.The consumer price index, the CPI, just isn’t the one that the Fed tracks. It’s also true that the basic CPI isn’t at 2%, nothing like:

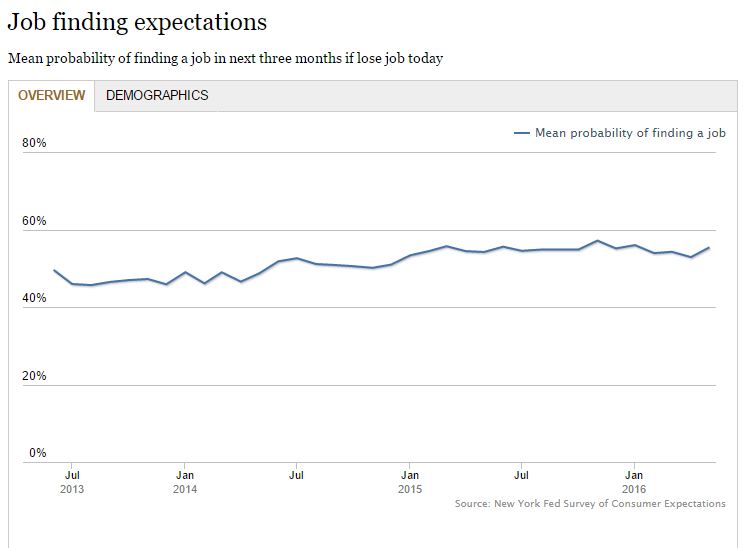

While another report on Thursday showed an increase in the number of Americans applying for unemployment benefits last week, the trend remained consistent with a healthy labor market. The data came a day after the Fed downgraded its assessment of the jobs market and gave a mixed view of the economy.

The Labor Department said its Consumer Price Index increased 0.2 percent last month, slowing from April’s 0.4 percent rise. Gasoline prices rose modestly and the cost of food fell.

The overall price index rose 1.0% in May from a year earlier, slipping from 1.1% annual growth in April. Prices excluding food and energy climbed 2.2% on the year, marking the seventh consecutive month that annual core inflation matched or exceeded 2%.

So, we’ve two inflation measures (and many many more variants but most of them make this same distinction) in the CPI. We’ve the, well, the CPI, and we’ve the core CPI. Food and fuels we know bounce around all the time. And while, in one strict sense, changes in them are inflation or deflation we don’t really think of them in quite the same way. Core inflation is thus everything except food and fuel. And core inflation is much more like the thing we want to worry about, “real” if you like inflation, where prices are just rising because prices in general are just rising.

So, if the Fed were to be looking at CPI it would be core CPI they looked at and that would be above 2% so raise? Ah, no, because the Fed uses a different inflation measure:

The important point to take away from this is that yes, the core CPI inflation rate is above 2%, the Fed’s target is 2% inflation, but they’re just not using this measure of inflation. So we can think of this as an interesting pointer to what we think the Fed’s preferred measure will be in the future, that PCE, but it’s not trigger time yet. And, if we’re honest about it, the inflation rate might not be the trigger they use at all. They could always (as I’ve been assuming they would for months now) use the existence of full employment as the trigger. It’s all rather like Churchill’s description of Russia, a riddle wrapped in an enigma and so on. We really don’t know quite what they’re going to do nor when they’re going to do it and we’ve not got a really good handle on what will make them do whatever either. Perhaps the major thing this speculation offers us is lots of well paid employment for economists on Wall Street trying to second guess. So, something good comes out of it after all.

Even though Private Money lenders are not affected by the interest rates it is interesting to know where the economy stands; the trends and variations that the Fed uses to measure inflation.

The Fed’s preferred inflation gauge — the Commerce Department’s personal consumption expenditures measure — hasn’t reached the central bank’s 2 percent goal since April 2012. The Fed has a dual mandate of stable prices and maximum employment.That’s actually running at about 1.6% at present. So still a bit of time before inflation becomes the trigger for the Fed. This is a little difficult though, for we know that monetary policy like raising rates takes about 18 months, perhaps 24 months, to have an effect upon inflation. So what is really being done it trying to predict what that PCE inflation rate will be 18 months in the future and then raise or not raise interest rates dependent upon that estimate. This is not science being done here folks, this is art, art by experienced and well meaning people but art all the same.

The important point to take away from this is that yes, the core CPI inflation rate is above 2%, the Fed’s target is 2% inflation, but they’re just not using this measure of inflation. So we can think of this as an interesting pointer to what we think the Fed’s preferred measure will be in the future, that PCE, but it’s not trigger time yet. And, if we’re honest about it, the inflation rate might not be the trigger they use at all. They could always (as I’ve been assuming they would for months now) use the existence of full employment as the trigger. It’s all rather like Churchill’s description of Russia, a riddle wrapped in an enigma and so on. We really don’t know quite what they’re going to do nor when they’re going to do it and we’ve not got a really good handle on what will make them do whatever either. Perhaps the major thing this speculation offers us is lots of well paid employment for economists on Wall Street trying to second guess. So, something good comes out of it after all.

Even though Private Money lenders are not affected by the interest rates it is interesting to know where the economy stands; the trends and variations that the Fed uses to measure inflation.